Das Modul Buchhaltung von Odoo ist eine voll integrierte, moderne Finanzsoftware. Odoo eignet sich vor allem als Buchhaltungssoftware für Kleinunternehmen. Praktisch jedes Unternehmen und jede Person in unserer Gesellschaft muss gegenüber Gläubigern, Regierungsbehörden und gemeinnützigen Organisationen professionelle Finanzbuchhaltungssysteme verwenden. Das Rechnungswesen von Odoo ist hervorragend für Unternehmen, welche ihre Geschäftsprozesse optimieren, ihre finanzielle Leistung steigern und ihre Abläufe an einem Ort rationalisieren möchten.

Odoo als Buchhaltungssoftware

Das Buchhaltungsmodul lässt sich in der Cloud, auf dem eigenen Server oder über hybride Integrationen einsetzen. Mit dieser nahtlosen Integration können wir kostbare Zeit und Aufwand einsparen und unsere Produktivität exponentiell steigern. Zahlreiche Unternehmen auf der ganzen Welt setzen dieses geschätzte Open Source ERP-System zusammen mit dem Modul Buchhaltung ein, um ihre Finanzen und Abläufe effizienter zu verwalten.

Zugriffsrechte

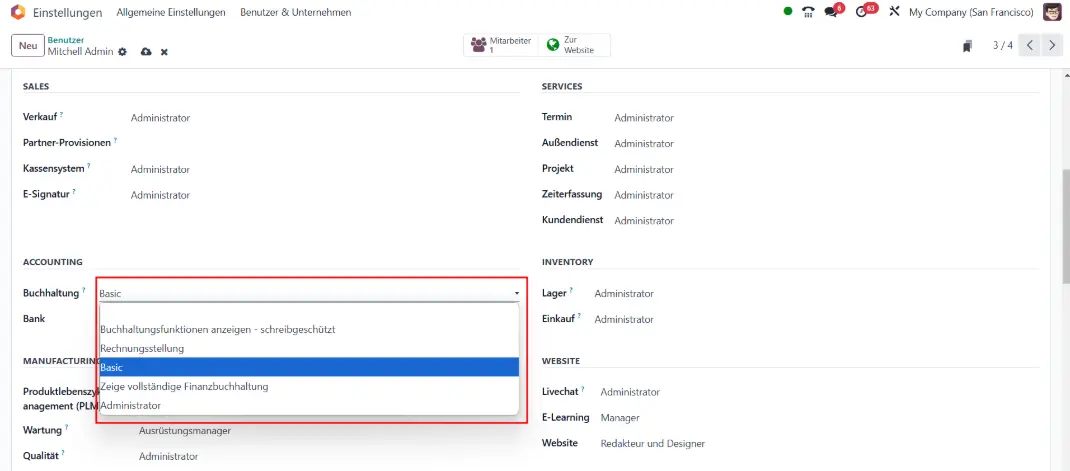

Zuallererst möchten wir auf die sechs Zugriffsrechte im Modul Buchhaltung aufmerksam machen.

Die niedrigste Stufe beinhaltet ausschließlich die Berechtigung, um Rechnungen zu erzeugen, die nächste zeigt zusätzlich Buchhaltungsfunktionen mit Leserechten. Die darauf folgende Stufe heißt "Zeige vollständige Finanzbuchhaltung" und zu guter Letzt gibt es den "Administrator", welcher uneingeschränkte Zugriffsrechte auf den vollen Funktionsumfang hat. Wählen wir kein Zugriffsrecht, sieht der User das Modul nicht in seinem Dashboard und kann ebenso nicht über die Suche auf sie zugreifen.

Grundlegende Einstellungen

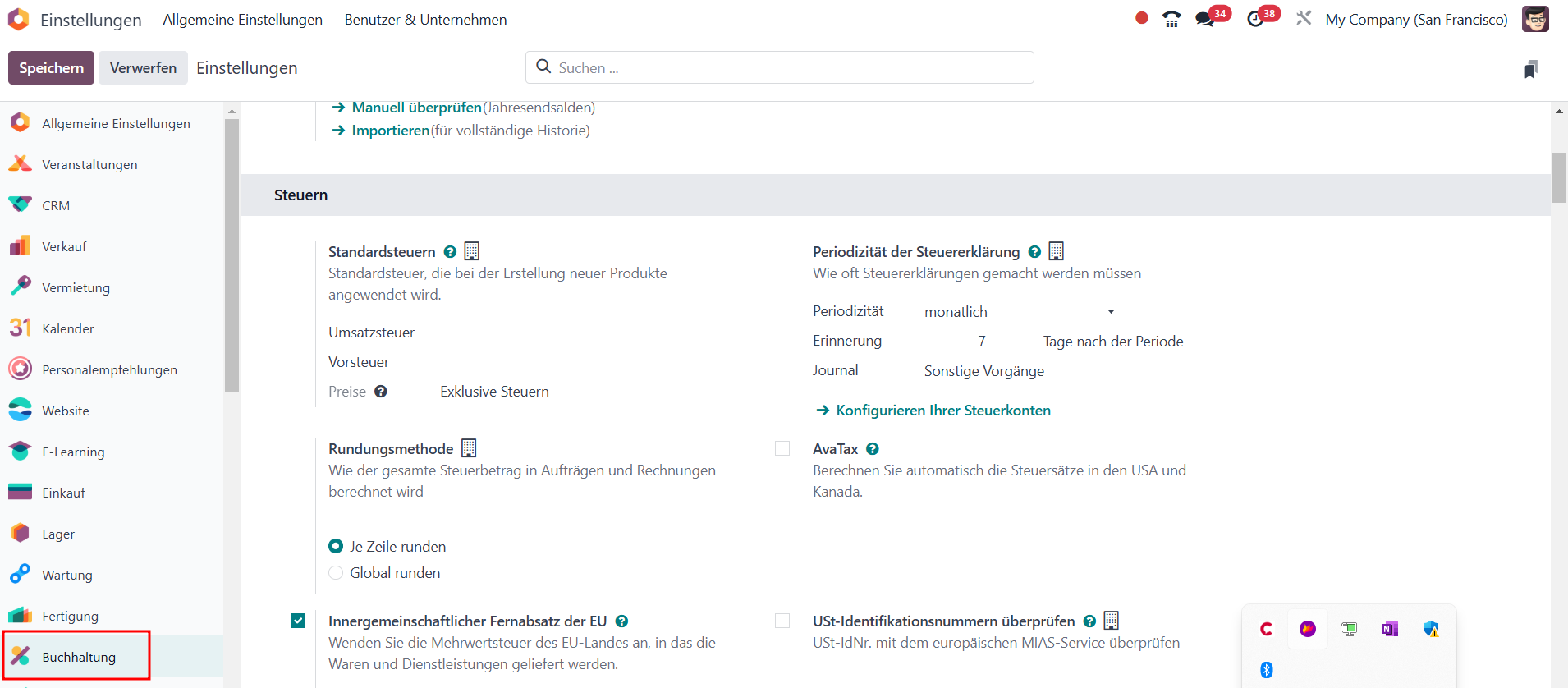

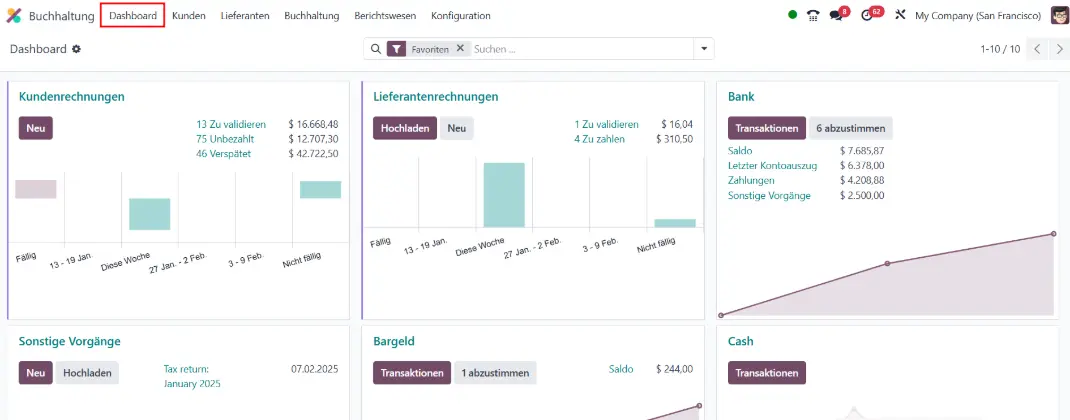

Im Menü finden wir die Einträge Dashboard, Kunden, Lieferanten, Finanzen, Berichtswesen und Konfiguration vor. Werfen wir zuerst einen kurzen Blick in den Konfigurationsbereich, bevor wir uns den einzelnen Schwerpunktthemen widmen. Angefangen bei den Standard-Steuereinstellungen, mit denen wir die Vorsteuer/Umsatzsteuer festlegen sowie die Einfuhrsteuer/Erwerbssteuer. Des Weiteren können wir festlegen, in welchen Perioden wir die Häufigkeit der Steuererklärung festlegen möchten. Zudem können wir entscheiden, ob das System die Rundungsmethode auf den gesamten Steuerbetrag "zeilenbasiert" oder auf die "komplette Summe" anwenden soll. Einige Einstellungen im Screenshot zeigen die Möglichkeiten für den U.S.-Markt.

Für E-Commerce Nutzer ist die Option "Innergemeinschaftlicher Fernabsatz in der EU" recht hilfreich. Sie umfasst den grenzüberschreitenden Verkauf von Waren und Dienstleistungen an einen privaten Verbraucher (B2C) in einem anderen EU-Mitgliedstaat, wenn der Verkäufer nicht persönlich mit dem Kunden zusammen trifft. Die Unternehmen müssen sicherstellen, dass die Mehrwertsteuer auf Fernverkäufe an den Mitgliedstaat abgeführt wird, in dem die Waren oder Dienstleistungen geliefert werden.

Mit der Option "Überprüfung der Umsatzsteuer-Identifikationsnummern (VAT)" überprüfen wir automatisch die USt.-IDs mit dem europäischen VIES-Dienst. Zudem legen wir noch das Steuerland fest, in dem unsere Buchhaltung geführt wird. Jetzt müssen wir noch die Haupt-Währung festlegen. Aktuell sind 167 Währungen im System hinterlegt. In den weiteren Abschnitten wie Kunden-Rechnungen, Kunden-Zahlungen, Lieferanten-Rechnung und Lieferanten-Zahlung nehmen wir die Grundeinstellungen für unsere Debitoren und Kreditoren vor.

Sofern wir das Modul Dokumente einsetzen, können wir unsere Lieferanten-Rechnungen mit einer Genauigkeit von 95 Prozent per OCR automatisch erfassen. Wie gut das funktioniert, können wir hier live testen. Das System kann innerhalb der Lieferanten-Rechnungen sogar die Konten pro Rechnungszeile auf der Grundlage früherer Rechnungen vorhersagen.

Der Bereich Ausgangsrechnungen bietet uns die Möglichkeit, die Versandeinstellungen für unsere Rechnungen zu definieren, Geschäftsbedingungen am Ende von Angeboten, Bestellungen und Rechnungen einzufügen sowie Warnungen am Kunden zu hinterlegen.

Wir können unsere Kunden direkt aus Odoo online über viele verschiedene Dienstleister bezahlen lassen. Die Gruppierung von Zahlungen in einem einzigen Stapel vereinfacht den Abstimmungsprozess - hierüber freut sich unser Buchhalter. Zudem können wir auf der Rechnung einen QR-Code für unsere Kunden als Zahlungsmöglichkeit ausgeben. Weiterhin können wir so viele Bankkonten wie nötig in unserer Datenbank verwalten. Wenn wir diese konfigurieren, stellen wir sicher, dass alle Bankdaten auf dem neuesten Stand sind. Dies bietet die Grundlage für den Abgleich unserer Journalbuchungen für den Verkauf und Einkauf.

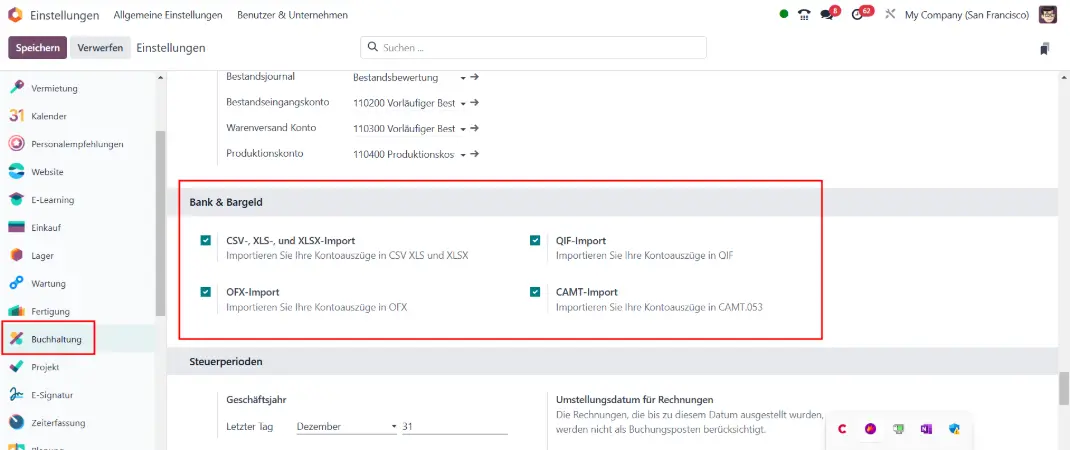

Unter "Bank & Cash" können wir festlegen, welche Import-Formate wir für unserer Bankkonten nutzen wollen. Uns stehen aktuell folgende Import-Formate zur Verfügung: CSV, CAMT, OFX, QIF. Zu guter Letzt können wir in der Konfiguration noch das Steuerjahr festlegen sowie die Kostenstellen und Budgets aktivieren.

Die verschiedenen Journale

Im Dashboard des Buchhaltungsmoduls sehen wir die wichtigsten Journale aus unserem Unternehmen. Als Erstes sehen wir die Kundenrechnungen, mit den darin befindlichen zu validierenden und unbezahlten Rechnungen in der Summe sowie die Fälligkeiten. Für jedes Journal zeigt uns Odoo auf einen Blick die Umsätze der letzten vier Kalenderwochen sowie die offenen Verbindlichkeiten für Kunden- und Lieferanten-Rechnungen an.

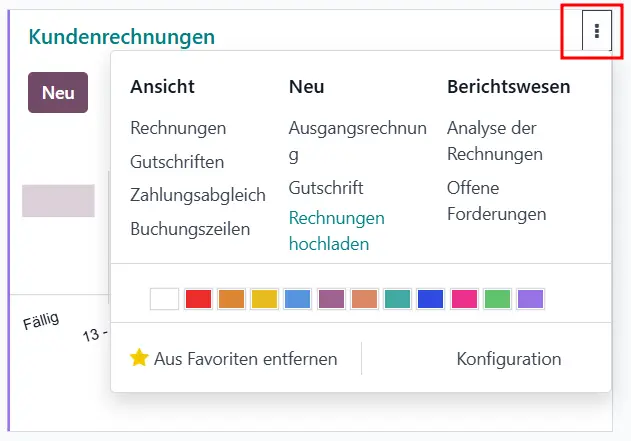

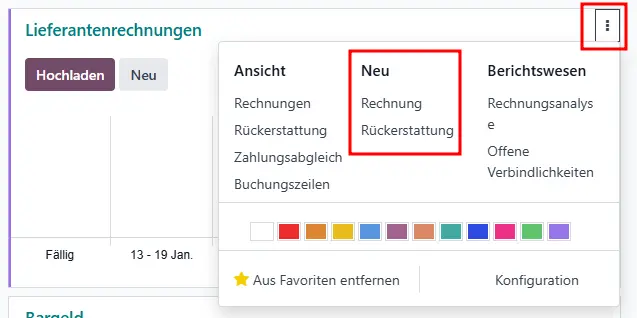

Ein jedes Journal beinhaltet ein kleines Konfigurationsmenü, in dem wir folgende Einstellungen und Ansichten einsehen können:

- unter "Ansicht" können wir Rechnungen, Gutschriften und Rechnungen abstimmen

- unter "Neu" können wir Rechnungen und Gutschriften direkt erstellen oder hochladen

- die "Berichtswesen" zeigen uns die Rechnungsstatistik, überfällige Forderungen und Mahnberichte

- mit den bunten Farben können wir unser Journal farblich markieren

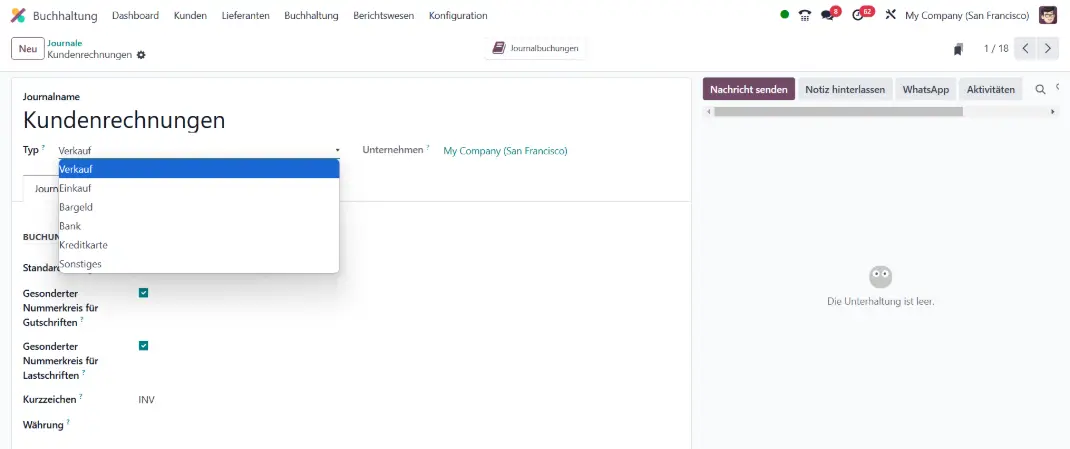

Das gelbe Sternchen legt unser Journal als Favoriten ab und lässt unser Dashboard gefiltert mit den Favoriten starten. Mit dem Punkt "Konfiguration" navigieren wir zu den Einstellungen eines jeden Journals. Hier können wir unter anderem die Journal-Typen festlegen, für welches Unternehmen das Journal in einer Multi-Company-Umgebung gültig ist und welcher Kontenplan standardmäßig greift.

Das Journal Lieferantenrechnungen unterscheidet sich zum Kunden-Journal im Wesentlichen darin, dass wir hier die Zahlungen unserer Lieferanten erfassen und Gutschriften ausstellen können. Vom Typ her ist dieses Konto unser Einkaufskonto.

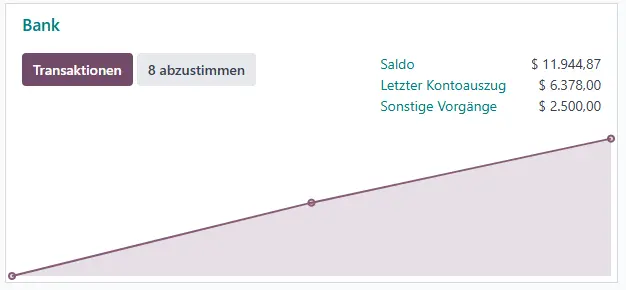

Mit dem Journal Bank können wir, wie bereits weiter oben erwähnt, beliebige Banken anlegen, Kontoauszüge automatisch beziehen, manuell erfassen oder als CAMT, CSV, OFX von unserer Bank importieren. Hier bietet sich auch die Möglichkeit unseren Bank online zu synchronisieren.

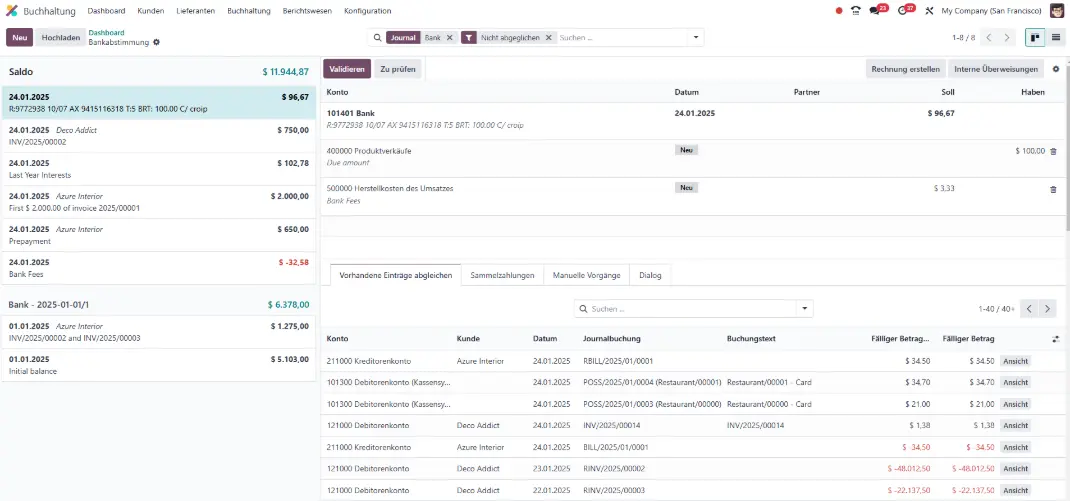

Haben wir die Eingangs- und Ausgangsrechnungen in Odoo gepflegt und die Kontoverbindungen sauber am Debitor oder Kreditor hinterlegt, ist der Abgleich per Mausklick in Windeseile erledigt und abgeglichen. Nachdem wir den "Abstimmungs"-Button betätigt haben, gelangen wir in die Übersicht der Bankabstimmung. Findet Odoo keine automatische Zuordnung, so haben wir die Möglichkeit, einen manuellen Abgleich von Zahlungen und Aufwendungen vorzunehmen.

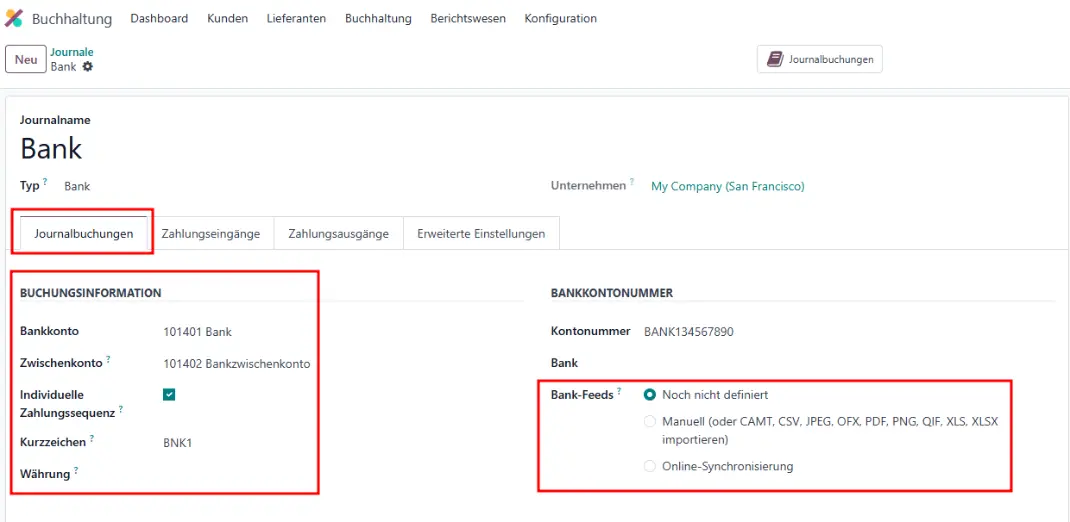

Das Bank-Journal kann bei Bedarf für verschiedene Kontotypen und weitere Journale verwendet werden. Hier sehen wir die Einstellungen vom Standard Bank-Journal, welches vorinstalliert ist. Im Tab "Journalbuchungen" sehen wir die generellen Kontoinformationen und auf der rechten Seite können wir den Import von externen Kontoauszügen unserer Bank einstellen.

Weiterführende Einstellungen und Funktionen

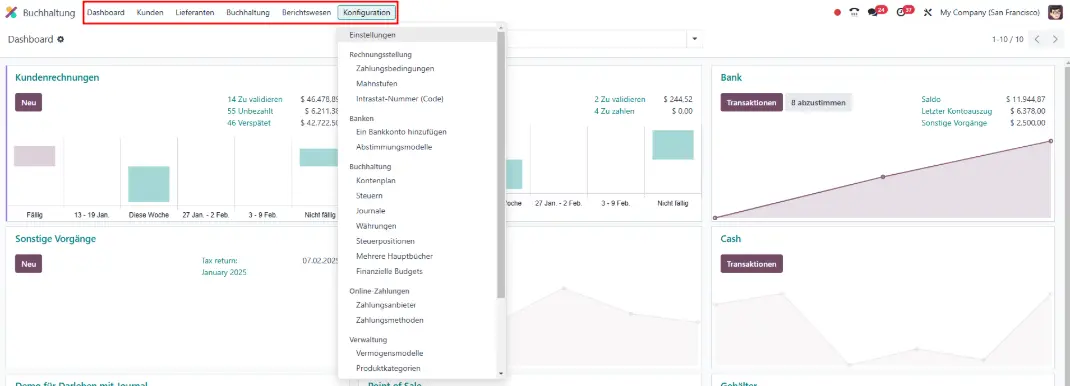

Die volle Kontrolle über unser Finanzwesen erhalten wir bei entsprechender Berechtigung über die Einstellmöglichkeiten im oberen Menü, in dem wir in das Management unserer Finanzflüsse, Berichte und weiteren Konfigurationen gelangen.

Im Konfigurationsmenü finden wir beispielsweise direkt die folgenden wichtigsten Einstellungen:

- Rechnungsstellung (Zahlungsbedingungen, Mahnstufe, Lieferbedingungen)

- Banken (Bankkonto hinzufügen, Abgleich Modelle, Online-Synchronisation)

- Buchhaltung (Kontenplan, Steuern, Journale, Währungen, Steuerpositionen)

- Zahlungsanbieter (Paypal, Alipay, Stripe, SEPA, u.v.m.)

- Produktkategorien, mit denen wir die Erlös- und Aufwandskonten, sowie Produktzuordnungen kontrollieren können

Wenn wir alles richtig gebucht haben, sollten wir in unseren wichtigsten Berichten der GuV und Bilanz tagesaktuelle Auswertungen ausgeben können, um diese als wichtige Grundlage für unsere monatliche Steuererklärung für den Export an DATEV, Lexware oder auch Adisson GOBD-konform übermitteln zu können. Eine optimierte Schnittstelle mit DATEV ermöglicht dabei unser Odoo DATEV Addon.

Fazit zu Odoo als Buchhaltungssoftware

Die Buchhaltungssoftware für Kleinunternehmen von Odoo punktet zusammengefasst mit folgenden Vorteilen:

- Reduzierung von Dateneingaben

- Gemeinsame Arbeit an Belegen

- Zahlungsabgleich von mehreren Rechnungen

- Einfache Einrichtung im Vergleich zu anderen Finanzsystemen

- Zugriff von verschiedenen mobilen Geräten wie Smartphones oder Tablets

- Online-Zahlungen via PayPal, Stripe, Ingenico, Adyen, etc.

- Manueller oder automatischer Abgleich von Kunden- und Lieferanten-Zahlungen über unsere Journale

- Unterstützung mehrerer Währungen und Unternehmen

- Leistungsberichte mit tagesaktueller Bilanz, GuV, Cash Flows und Kassenberichten

- Verwaltung von Abonnements und wiederkehrenden Umsätzen

- Verwaltung von Vermögenswerten und Abschreibung

- Budgetverwaltung über analytische Konten

- Rechnungsabgrenzungsposten

- DATEV Export von Debitoren und Kreditoren (Zusatz-Modul) nach GOBD-Konformität

Du bist auf der Suche nach einem ERP-System, mit dem du neben deinen Geschäftsprozessen auch deine vollständige Finanzwelt abbilden kannst oder hast Fragen zum Modul Buchhaltung? Kontaktiere uns jetzt und wir stehen dir als erfahrener Odoo-Partner zur Seite!

Quellen: odoo.com (Stand: Oktober 2025)

Odoo - die beste Buchhaltungssoftware für Kleinunternehmen