Die Umsatzsteuer-Identifikationsnummer (USt-IdNr.) dient zur eindeutigen Identifizierung von Unternehmen innerhalb der Europäischen Union (EU) und kann beim Finanz- oder Bundeszentralamt beantragt werden. Unternehmen, die innergemeinschaftliche Geschäfte steuerfrei durchführen wollen, sind zur Prüfung der ausländischen USt-IdNr. angehalten.

Das Bundeszentralamt für Steuern beschreibt die Prüfung von ausländischen USt-IdNr. als "die Prüfung, ob zum Zeitpunkt der Leistungserbringung die Lieferung oder sonstige Leistung an einen in einem anderen Mitgliedstaat der EU registrierten Unternehmer ausgeführt wird. Die Unternehmereigenschaft des Leistungsempfängers ist nachzuweisen, um eine Lieferung - bei Vorliegen der weiteren Voraussetzungen - als steuerfrei behandeln zu können. Bei sonstigen Leistungen ist durch Nachweis der Unternehmereigenschaft des Leistungsempfängers eine Verlagerung der Steuerschuldnerschaft auf den Leistungsempfänger möglich."

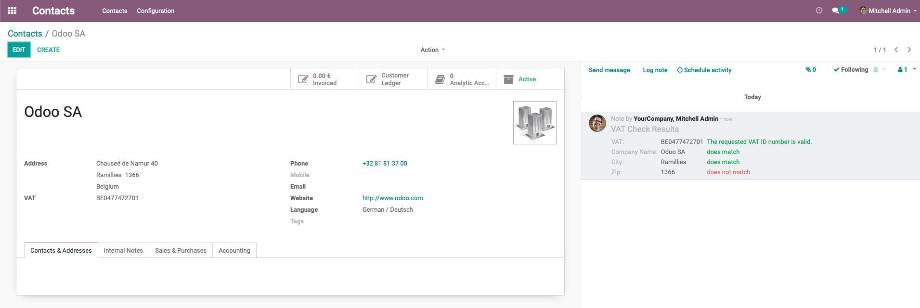

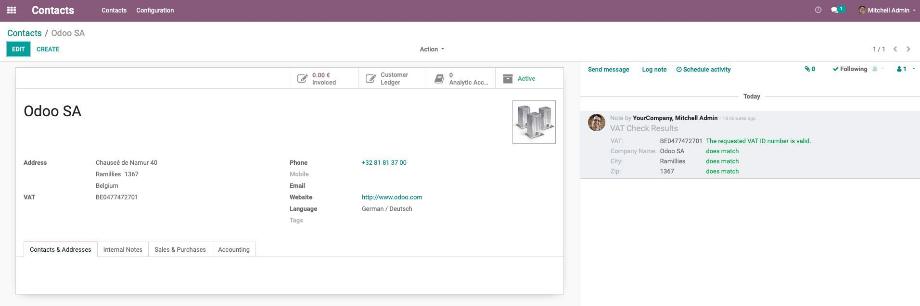

Das Bundeszentralamt für Steuern unterscheidet bei der Prüfung zwischen dem einfachen oder qualifizierten Bestätigungsverfahren. Die einfache Bestätigungsanfrage prüft die Gültigkeit der ausländischen USt-IdNr. Die qualifizierte Bestätigungsanfrage prüft zusätzlich, ob die Angaben zu Namen, Ort, Postleitzahl und Straße des Unternehmens übereinstimmen.

Die Prüfung der USt-IdNr. kann online beim Bundeszentralamt für Steuern vorgenommen werden. Alternativ können Anfragen auch per Post, Telefon, Fax oder E-Mail, ebenfalls beim Bundeszentralamt für Steuern, gestellt werden. Zusätzlich dazu stellt das Bundeszentralamt für Steuern eine XML-RPC-Schnittstelle zur Verfügung, welche die Möglichkeit bietet, die Prüfung direkt in das ERP-System eines Unternehmens zu integrieren.

Odoo bietet im Standard kein Modul zur Prüfung von ausländischen USt-IdNr. Das Entwicklerteam der manaTec hat dafür allerdings ein Modul entwickelt, welches die Prüfung von ausländischen USt-IdNr. in Odoo integriert.

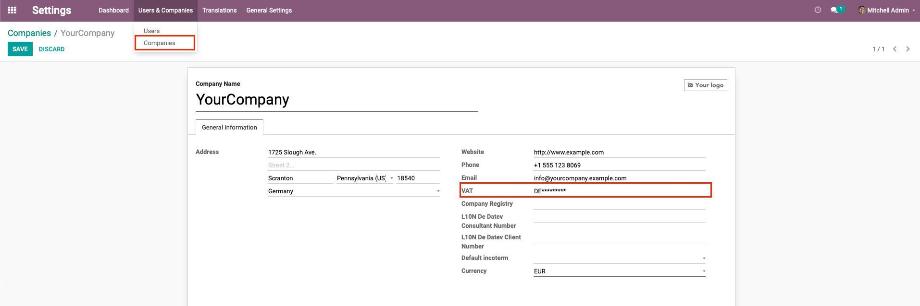

Die Konfiguration zur Aktivierung der Prüfung der ausländischen USt-IdNr. erfolgt in wenigen Schritten. Zuerst benötigen wird die Angabe der eigenen USt-IdNr., welche die Voraussetzung zur erfolgreichen Prüfung der ausländischen USt-IdNr. ist. Dafür navigieren wir zu den Einstellungen --> Benutzer & Unternehmen --> Unternehmen und tragen dort unsere USt-IdNr. ein.

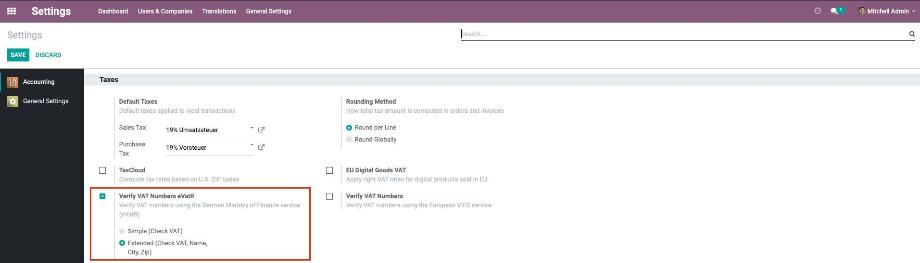

Im zweiten Schritt navigieren wir zu den allgemeinen Einstellungen im Modul Finanzen. Dort aktivieren wir die Prüfung der ausländischen USt-IdNr.

Zusätzlich haben wir die Möglichkeit zu definieren, ob wir die einfache oder qualifizierte Bestätigung durchführen wollen. Zur Vollständigkeit von richtigen Daten empfiehlt es sich an dieser Stelle in jedem Fall, die qualifizierte Bestätigungsanfrage zu aktivieren.

Die Prüfung der ausländischen USt-IdNr. erfolgt nun im Modul Kontakte beim Anlegen eines neuen Kontaktes oder bei der Änderung des Unternehmensnamens, der USt-IdNr. oder der Anschrift eines bestehenden Kontaktes. Die Ergebnisse der Abfrage werden anschließend in der Historie des Kontaktes geloggt. Stimmen die Daten der Abfrage nicht mit der Prüfung überein, empfiehlt das Bundeszentralamt für Steuern die Kontaktaufnahme mit dem Unternehmen zur Abfrage der korrekten Daten.

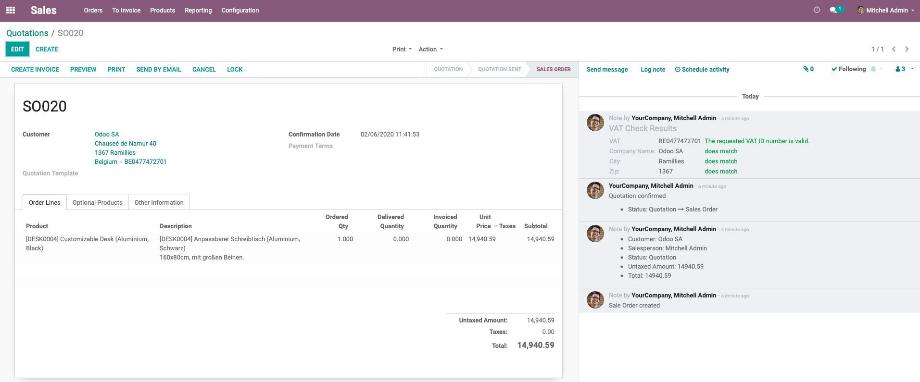

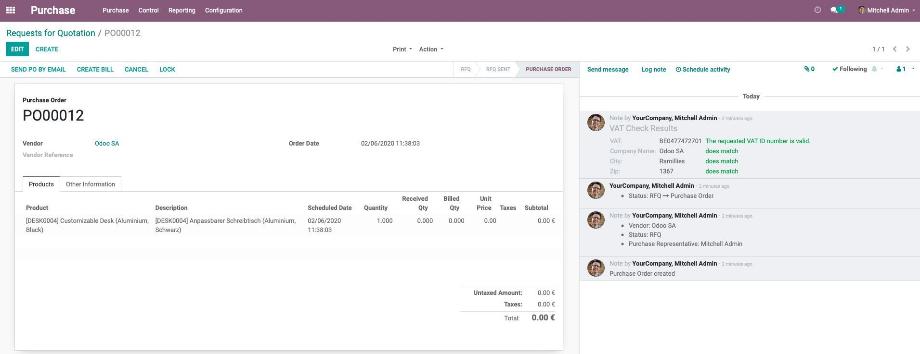

Zusätzlich zur Abfrage der ausländischen USt-IdNr. im Kontaktobjekt erfolgt die Prüfung auch in den Modulen Verkauf und Einkauf bei der Bestätigung eines Verkaufs- oder Beschaffungsauftrages. Das Ergebnis der Prüfung wird dabei in der Historie des Verkaufs- oder Beschaffungsauftrages geloggt. Auch an dieser Stelle empfiehlt sich die Kontaktaufnahme mit dem Kunden bzw. Lieferanten, sollte die Prüfung Unstimmigkeiten in der Richtigkeit der Daten ergeben.

Der große Vorteil unseres Moduls liegt nicht nur in der Prüfung der ausländischen USt-IdNr., sondern zweifelsohne in der vollständigen Automatisierung dieser Abläufe. Dabei erfolgt die Abfrage nicht nur einmal initial, sondern immer bei der Änderung der relevanten Daten eines Kontaktes sowie bei jedem Verkaufs- und Einkaufsvorgang. Somit stellen wir sicher, dass die Kontaktdaten unserer Kunden und Lieferanten stets aktuell sind und verhindert damit die Gefahr von ungewollten und gegebenenfalls hohen Steuernachzahlungen.

Sie nutzen bereits Odoo und sind auf der Suche nach einem voll automatisierten Tool zur Prüfung der USt-IdNr. Ihrer Geschäftspartner im EU-Ausland? Sie haben Fragen zu diesem oder unseren anderen Modulen? Kontaktieren Sie uns jetzt und wir stehen Ihnen sehr gern als zuverlässiger Partner zur Seite!

Quellen: www.odoo.com, www.bzst.de (Stand: November 2025)

Odoo - Integrierte Bestätigung ausländischer USt-IdNr.