Durch die Einführung der E-Rechnung, welche durch die E-Rechnungsverordnung der Bundesregierung im November 2018 in Kraft gesetzt wurde, konnte die bisherige Digitalisierung von Geschäftsprozessen weiter vorangetrieben werden. Sie bietet die Möglichkeit, Rechnungen zu digitalisieren, damit diese automatisiert weiterverarbeitet werden können. Um E-Rechnungen zu erstellen, wird ein Datenstandard zur Vereinheitlichung von elektronischen Rechnungen verwendet, die XRechnung, welche ein rein digitales Format auf XML-Code Basis darstellt. Eine weitere effiziente Möglichkeit zur Erstellung der E-Rechnungen stellt der Factur-X-Standard dar, der in diesem Artikel näher betrachtet wird.

Das Datenformat ZUGFeRD für elektronische Rechnungen (Zentraler User Guide des Forums elektronische Rechnungen Deutschland) macht es möglich, das Format PDF lesbar zu machen und enthält in dieser Datei zusätzlich eine strukturierte XML-Datei. Zunächst hat das Bundesministerium für Wirtschaft und Energie ZUGFeRD für den Wirtschaftsbereich entwickelt, mittlerweile können auch Anforderungen der Verwaltungen und Behörden umgesetzt werden, da mit der Version 2.1.1 auch die XRechnung unterstützt wird. Die verschiedenen Anforderungen an elektronische Rechnungen können bei ZUGFeRD über unterschiedliche Profile, wie z.B. mit geringem Anforderungsniveau (BASIC) oder höherem Anforderungsniveau (EXTENDED), gesteuert werden. Durch dieses Einsatzgebiet kommt das hybride Format vor allem im B2B und B2C zum Einsatz.

Was ist Factur-X?

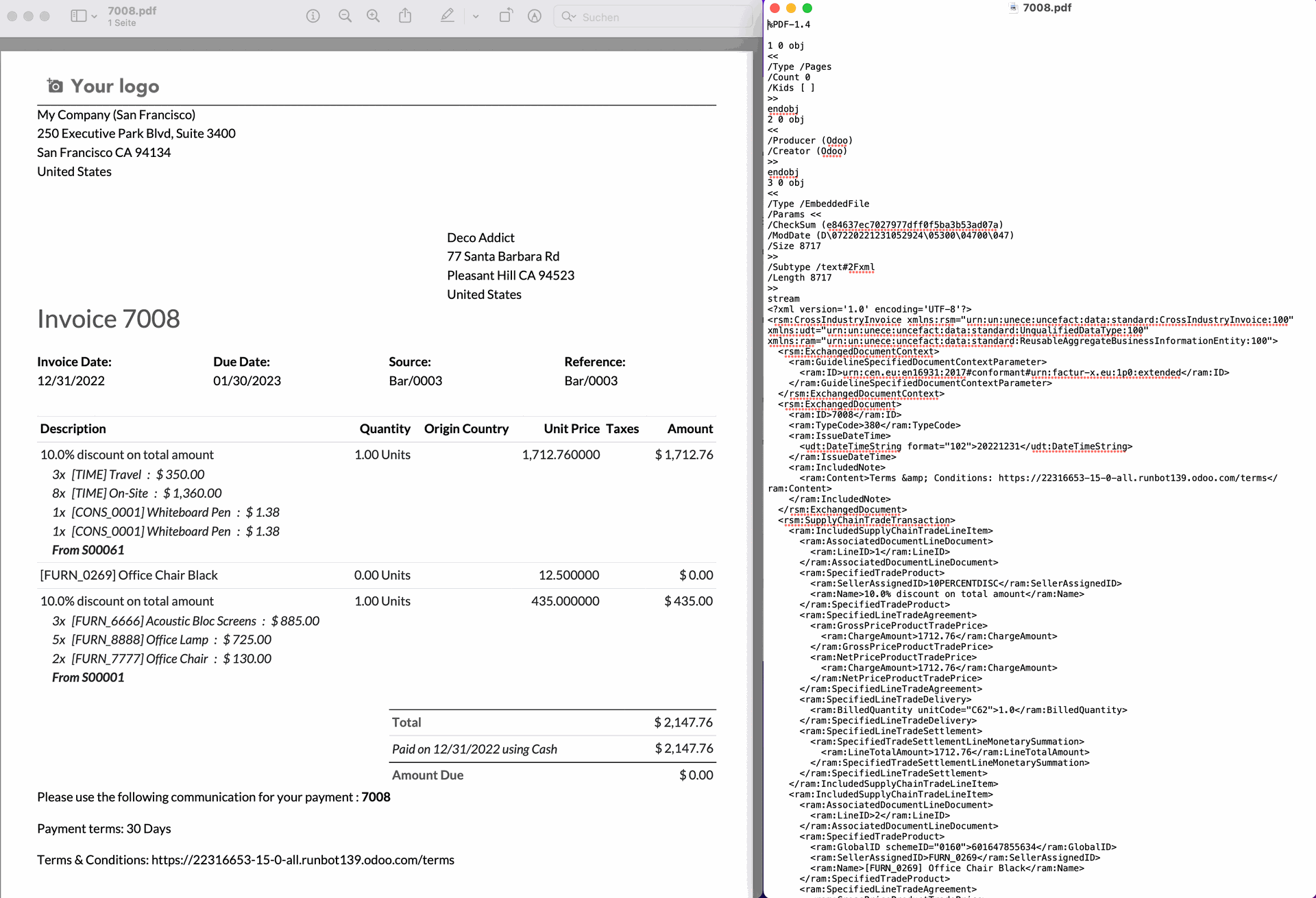

Der Factur-X-Standard ist ein E-Invoicing-Standard für Frankreich und Deutschland, welcher es ermöglicht, E-Rechnungen für Unternehmen aller Art realisierbar zu machen. Der Standard ist vollständig kompatibel und identisch mit der deutschen Version ZUGFeRD 2.0, jedoch wird international die Bezeichnung Factur-X verwendet. Dieses Hybridformat für elektronische Rechnungen vereint die verbreitetsten Rechnungsformate PDF und XML. Dazu wird eine strukturierte Rechnung (XML) und eine visuelle Rechnung (PDF) in einem PDF-Dokument eingebettet, um so einfacher weiterverarbeitet zu werden.

Öffnen wir wie gewohnt über die Formularansicht einer Kundenrechnung die Factur-X konforme PDF-Datei, ist der eingebettete XML-Code nicht direkt sichtbar. Lesbar wird dieser durch beispielsweise einen Editor, jedoch kann der XML-Code direkt bei der Versendung der Datei von Maschinen gelesen werden.

Ziel dessen ist es, in diesem Format ein Maximum an strukturierten Informationen zu generieren, welche einen Mehrwert für Zulieferer und Rechnungssteller bieten. Factur-X unterstützt daher mehrere Anwendungsprofile, da es allen in der europäischen Norm EN16931 enthaltenen Rechnungsinformationen, sowie den geforderten Mindestrechnungsinformationen entspricht.

XRechnung vs. Factur-X

Sowohl die XRechnung, als auch Factur-X basieren auf der europäischen Norm EN16931, welche als zulässige Syntaxen die UBL (Universal Business Language) und CII (Cross Industry Invoice) festlegt. Umsetzbar ist die XRechnung in beiden Syntaxen, jedoch ist ZUGFeRD und somit Factur-X nur als CII umsetzbar. Zudem unterstützt das Format der XRechnung noch 21 weitere nationale Geschäftsregeln und erfüllt daher auch die speziellen Anforderungen der deutschen Behörden und Verwaltungen. Es ist beispielsweise für die XRechnung- verpflichtend die Leitweg-ID, auch bekannt als Käuferreferenz, anzugeben. Im Vergleich zu Factur-X ist die XRechnung ein rein digitales Format, welches nur auf XML-Code basiert. Daher ist, im Gegensatz zum eingebetteten XML in die PDF-Datei des Factur-X-Formats, eine Schnelleinsicht in Form einer PDF bei der XRechnung nicht möglich. Als nachhaltiger Standard kann das XRechnungs-Format innerhalb Deutschlands verwendet werden, Factur-X geht jedoch sogar über die deutschen Landesgrenzen hinaus und genießt daher internationale Akzeptanz.

Unterstützte Anwendungsprofile von Factur-X

Factur-X unterstützt durch sein breites Anwendungsgebiet verschiedene Profile, die angesteuert werden können. Das Profil MINIMUM stellt sozusagen die Basis dar, in dem es als Buchungshilfe nur wesentliche Angaben zu dem Verkäufer und Käufer, als auch der Gesamtumsatzsteuer und dem Gesamtrechnungsbetrag angibt. Im BASIC Profil können schon Rechnungen erzeugt werden, die dem Umsatzsteuergesetz entsprechen. Hingegen enthält das Profil COMFORT (EN 16931) alle für die elektronische Rechnung benötigten Inhalte, welche der europäischen Norm EN 16931 entsprechen. Mit dem Profil EXTENDED schafft es Factur-X verschiedene Geschäftsprozesse mit einer Erweiterung von EN 16931 zu unterstützen.

Konfiguration Factur-X in Odoo

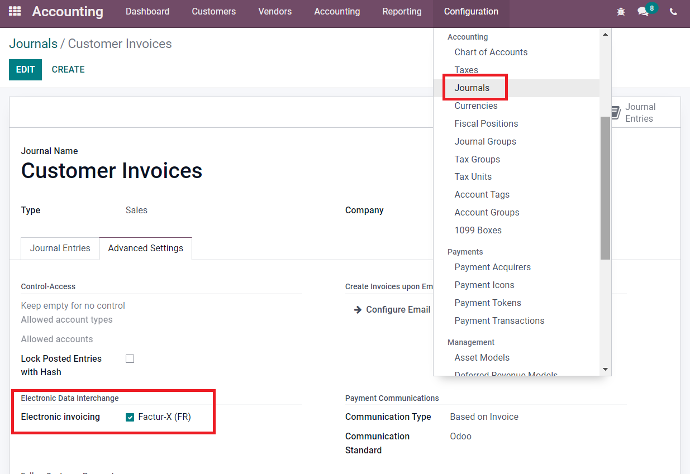

Um Factur-X in Odoo zu konfigurieren, wählen wir im Accounting Modul unter “Configuration” die “Journals” aus. Factur-X kann man nun in den “Advanced Settings” einstellen. Diese Einstellung ist jedoch meist schon gegeben, daher ist für XFactur keine eigenständige Konfiguration nötig.

Export der XML-Dateien

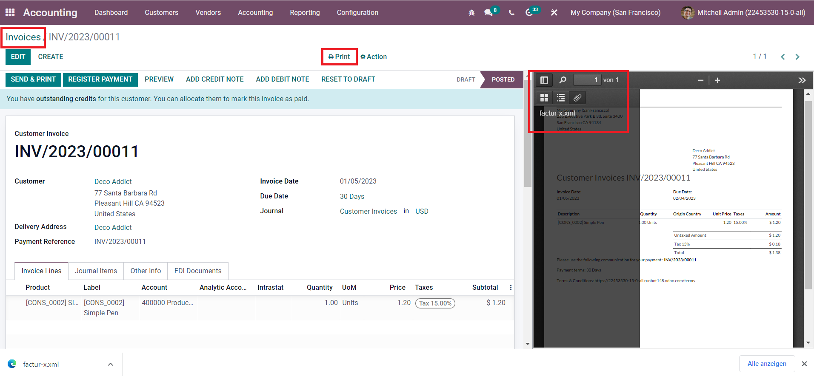

Factur-X ermöglicht eine automatische Generierung von XML-Dateien beim Erstellen neuer Rechnungen im Journal. Somit können alle XML-Dateien visualisiert und extrahiert werden, da sie in der PDF-Ansicht zuallererst nicht sichtbar sind. Dazu muss der Debug-Modus aktiviert sein. Im Accounting Modul öffnen wir eine Rechnung (unter Customers und dann Invoices). Um den Factur-X-Anhang zu öffnen, klicken wir auf “Print”, dann öffnet sich die PDF-Ansicht der gewählten Rechnung und wir können im Anhang die Factur-X-XML-Datei extrahieren.

Extended Tip

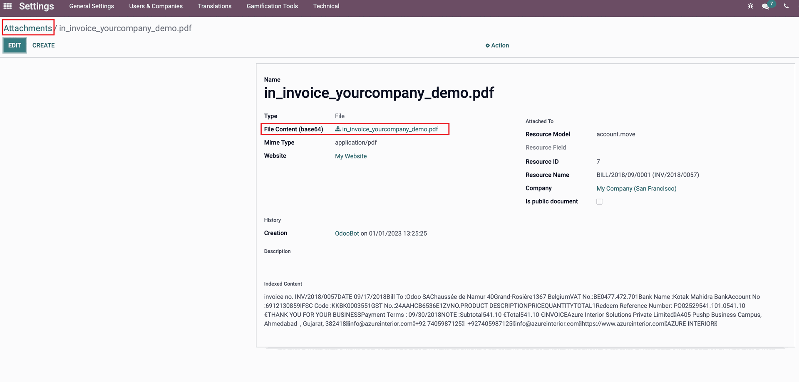

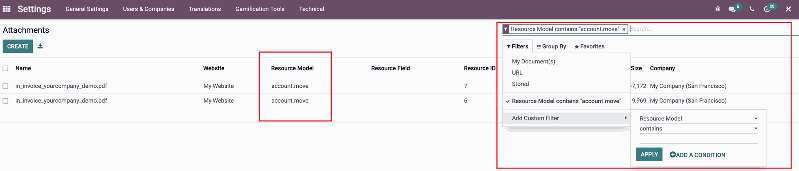

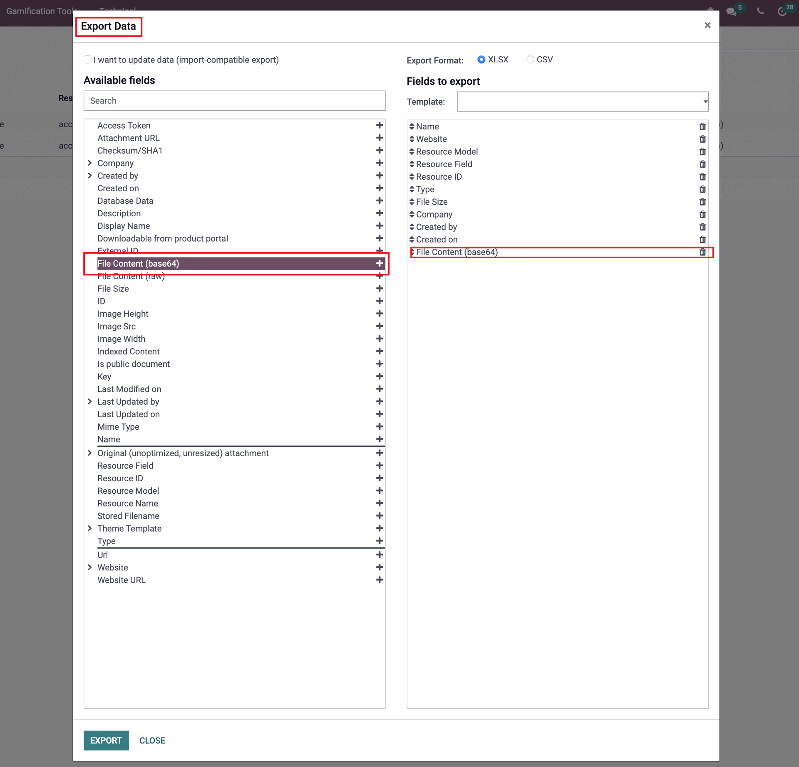

Ein weiterer Weg um in Odoo das XFactur Datenformat zu nutzen: Unter Einstellungen öffnen wir "technisch", wählen "Datenbankstruktur und Anhänge", dort können alle Anhänge der gesamten Datenbank gelistet werden, einschließlich der mit den Rechnungen verknüpften XML-Dateien. Um die XML-Dateien der Rechnungen anzuzeigen und zu extrahieren, wechseln wir zur Listenansicht und filtern nach dem Ressourcenmodell: “account.move”. Die XML-Dateien können direkt extrahiert werden, indem in der Rechnung das Feld “File Content (base64)” zum Download genutzt wird oder es können alle Rechnungen in Excel exportiert werden.

Mit Factur-X müssen Sie ihre Gewohnheiten nicht ändern, sondern können ihre Rechnungen wie gewohnt per E-Mail versenden. Verfügt man bereits über eine moderne Buchhaltungssoftware, können die Factur-X-Rechnungen automatisch als Lieferantenrechnungen importiert werden, da sie alle Vorteile der integrierten XML-Datei nutzen können. Selbst falls noch keine moderne Buchhaltungssoftware vorhanden sein sollte, lässt sich die Factur-X-Datei einfach mit einem Reader öffnen, sodass das Dokument auch manuell als Lieferantenrechnung eingepflegt werden kann. Vorteilig an Factur-X ist, dass mit dem hybriden Format Steuervorschriften eingehalten werden und es auch keine zusätzlichen Kosten (wie Portokosten für den Versand von Rechnungen) verursacht. Damit wird ein Datenaustausch nicht nur schneller, sondern auch sicherer, wodurch sich durch den optimalen Prozess der Rechnungsverarbeitung der Workflow verbessern kann. Im Ganzen ist der elektronische Rechnungsaustausch zwischen Unternehmen und den öffentlichen Behörden und Verwaltungen mit dem einheitlichen Standard Factur-X noch komfortabler geworden, womit sie bestens für künftige Entwicklungen in der Digitalisierung ausgestattet sind.

Sie sind auf der Suche nach einem ERP-System, das die ideale Basis für die Integration von E-Rechnungen in moderne Geschäftsprozesse bildet? Kontaktieren Sie uns jetzt, wir helfen Ihnen gerne weiter!

Quellen: www.symtrax.com, www.odoo.com, www.afi-solutions.com, www.awv.net

Rechnungen in Odoo als XML-Datei